Nomads traveling the planet chase freedom, Wi-Fi, and good coffee. Yet many forget one hard truth: accidents abroad cost money. Choosing cover is not fun, but skipped steps can break a trip. This guide lists the biggest blunders nomads travel lovers still make when shopping for protection. You will see tips for nomad health, nomad healthcare, and expat health insurance, plus real-world cues from annual multi trip insurance and every travel insurance annual policy on the market. Read on to avoid rookie errors and move with confidence.

Mistake 1 – Matching a short policy to a long journey

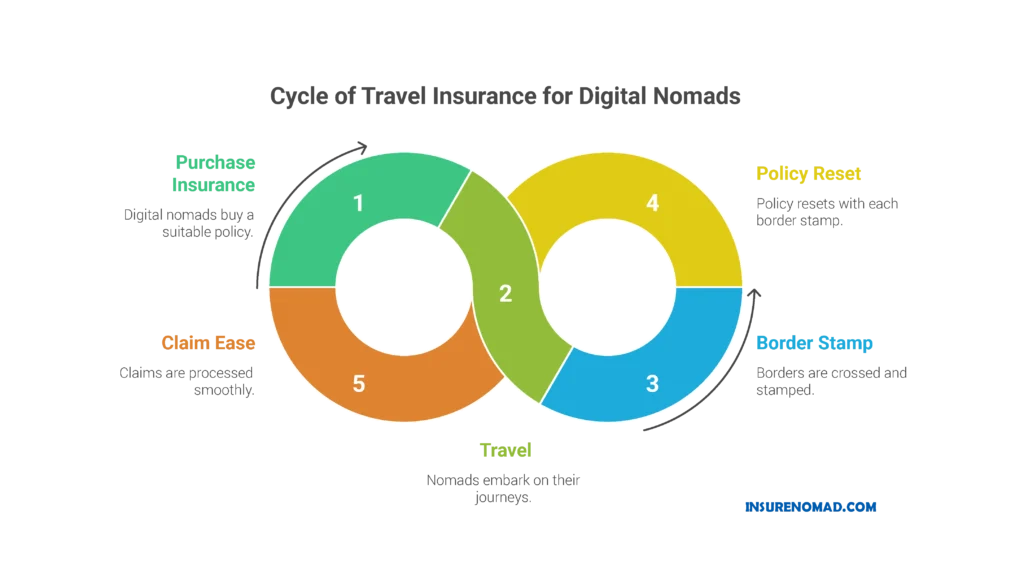

Digital workers hop borders all year. A 30-day single-trip plan feels cheap, but it leaves gaps once the first month ends. Seasoned nomads traveling often forget they need an annual multi trip insurance contract or a flexible travel insurance annual policy that resets with every border stamp. Buy once; roam often. That way, claims stay easy and the insurer will not question your exit dates.

Mistake 2 – Ignoring local entry rules

Some visas demand proof of expat health insurance at customs. Southeast Asia, Latin America, even parts of Europe now scan your certificate. If your document lacks required wording, you may face last-minute airport fines. Always read embassy pages. If rules mention minimum coverage or COVID certificates, email support at least a week before boarding. Many providers issue confirmation letters in hours when asked.

Mistake 3 – Confusing travel cover with nomad healthcare

Travel insurance shines for flights, bags, and sudden emergencies. Nomad healthcare, in contrast, treats ongoing needs: prescriptions, therapy, dental checks. Travelers who believe one plan does both often suffer. Separate products or hybrid bundles solve the issue. Check for outpatient care, mental-health sessions, and direct-billing hospitals. Good nomad health stays steady even when you stay months in one place.

Mistake 4 – Trusting glossy ads without research

An influencer posts a glowing world nomads review. Another praises a slick safetywing insurance review. Both might be honest. Yet coverage changes. Reading the actual PDF is still crucial. Scan exclusions, deductibles, and claim limits in local currencies. Then call the listed world nomads phone number or live chat with the brand you fancy. If the answers feel vague, walk away.

Mistake 5 – Buying the cheapest plan during a sale

Flash discounts tempt. But a $50 plan with a $5,000 deductible is not a bargain if you break an ankle. Compare benefits line by line. Balance price, limit, and service speed. Annual multi trip insurance from a big carrier may look pricey yet offer 24/7 evacuation hotlines and automatic policy renewal—lifesavers when nomads travel through remote terrain.

Mistake 6 – Skipping pre-existing condition checks

Asthma, allergies, or old knee injuries follow you abroad. Some insurers cover them if declared early; others deny all related claims. List every chronic issue up front. Extra screening takes minutes and prevents heartbreaking denials later. Transparency keeps nomad healthcare reliable and builds trust with claims officers.

Mistake 7 – Assuming evacuation is standard

Medical evacuation costs can crush budgets. Helicopters in the Andes, air ambulances over the Pacific—think five-figure sums. Many travel insurance annual policy tiers cap evacuation at $100,000. Complex rescues burn that fast. Choose at least $500,000 for worldwide trips. If you love cliff hikes or diving, aim higher.

Mistake 8 – Forgetting gear coverage for work tools

A freelance videographer hauls cameras worth $3,000. A writer carries a laptop essential to income. Standard policies limit electronics to $500. Buy add-on valuable items cover, or name devices individually. A lost bag then becomes a nuisance, not a career stopper.

Mistake 9 – Overlooking regional war or unrest exclusions

News can shift fast. Regions once calm can flare overnight. Policies often exclude claims in travel-advisory zones. Keep a browser tab on government advisories. Update underwriters if you route through such areas. Good nomad health remains valid only when you play by the booklet rules.

Mistake 10 – Missing renewal notifications

Nomads traveling across time zones lose track of calendar alerts. Many policies auto-renew, but the card on file may expire. A quick email from support may land in spam. Mark renewal dates in two apps. Test the world nomads phone number or the helpline of your provider before renewal week. A ten-minute call saves endless paperwork after a silent lapse.

Mistake 11 – Believing unlimited means truly unlimited

Some plans tout unlimited medical cover yet cap daily hospital room rates, outpatient visits, or rehab sessions. Read the fine print. “Unlimited” usually refers to aggregate lifetime ceilings, not every sub-section. Better to have a clear $1 million limit with generous sub-caps than fuzzy infinity signs.

Mistake 12 – Ignoring customer-service response time

Time is vital in emergencies. An insurer may brag about global reach, but if chat replies in 48 hours you could sit in an ER lobby fretting. Scan forums. A frank safetywing insurance review or a balanced world nomads review often mentions wait times. Ring the hotline once from home. Speed matters.

Mistake 13 – Choosing the wrong brand for expat staysure niche needs

Staysure expat insurance and its relative expat staysure products cater to retirees or long-term residents, not backpackers. Their policies focus on stability rather than constant border hops. If you fit that slower rhythm, they shine. If you sprint across continents monthly, look elsewhere. Match lifestyle to model.

Mistake 14 – Forgetting dental and mental-health add-ons

Outpatient therapy and fillings rarely come in basic packages. Nomad healthcare must treat mind and mouth too. Providers now sell small riders covering six counseling sessions or annual check-ups. They raise price modestly but save hassle later. Healthy smiles and minds keep nomads traveling longer.

Mistake 15 – Relying on a single payment card

Banks freeze cards on international moves. If the insurer can bill only one card, renewal may fail. Store two cards or enable PayPal backup. Survival tip: email accounts and world nomads phone number updates together when you replace cards.

Mistake 16 – Skipping policy localization

Some countries require health certificates in their language. Check whether your insurer issues translated attestations. This step helps at border checkpoints and clinic desks, keeping nomad health claims smooth.

Mistake 17 – Not keeping digital and paper copies together

Cloud folders break, phones fall in water. Print the summary page, emergency contact list, and passport. Tuck them in a waterproof pouch. Add QR codes for the claims portal and safetywing insurance review PDF if you need quick references while offline.

Mistake 18 – Underestimating lifestyle changes over time

A slow traveler may settle for budget cover at first. After a year, surfing, skiing, or high-altitude trekking may enter the picture. Update your portfolio. Top-up modules exist for sports, pregnancy, or family add-ons. Annual multi trip insurance lets you tweak benefits at renewal, keeping pace with evolving risks.

Mistake 19 – Skipping immunization or routine care because insurance is enough

Nomad healthcare works best with prevention. Vaccines, check-ups, and good sleep beat hospital nights. Many expat health insurance contracts include wellness allowances. Use them before they expire.

Mistake 20 – Failing to compare direct-seller vs broker service

A broker layers advice, sometimes at no extra cost. They explain exclusions in plain English and chase claims. Direct sellers can be cheaper but leave you decoding jargon alone. Read an unbiased expat staysure breakdown or world nomads review to decide.

Action checklist (print this)

- Map travel dates for 12 months.

- Match a travel insurance annual policy or annual multi trip insurance to that map.

- Note embassy health rules for each destination.

- List pre-existing conditions and send to insurer.

- Check evacuation limit ≥ $500k.

- Value your gear and add cover.

- Scan war-zone clauses weekly.

- Save renewal reminders and the insurer’s phone number.

- Verify customer-service speed via live test.

- Add mental-health and dental riders if needed.

Conclusion

Insurance is not the most thrilling part of nomads travel life, but it keeps dreams intact. Avoid these common mistakes and your nomad health journey will stay on track. Whether you lean on a new safetywing insurance review, ring the world nomads phone number for clarity, or dive into a detailed staysure expat insurance brochure, knowledge is leverage. Do the homework once. Then close the laptop, grab the pack, and join the growing wave of nomads traveling the globe, safe in the knowledge that every chapter—short hop or year-long stay—has solid backup behind it.