Swipe a shiny rewards card, snag lounge access, and—boom—insurance is “included.” For many nomads travel the globe on tight budgets, that perk feels like a life-hack. Yet the fine print often ends adventures in debt. This guide unpacks why nomads traveling long term or settling abroad as expats need more than card benefits and how to build a resilient safety net.

1. What credit-card insurance really is (and isn’t)

Most issuers bundle trip-cancellation, baggage, and limited medical coverage. Those clauses are designed for holidays that start and end in your home country and last 30–90 days at most(NOMADS). They seldom cover routine care, preventive dentistry, mental-health sessions, or sports injuries—daily realities for location-independent workers. Worse, reimbursement is usually secondary. You pay first, then haggle for months.

2. Duration limits clash with nomadic timelines

A true digital-nomad itinerary is open-ended: a quarter in Chiang Mai, half a year in Tbilisi, a sprint through Medellín. Stay away longer than the card’s cap and the policy voids automatically. Providers confirm trip length through boarding passes, geo-tagged receipts, even the banking app’s location pings(NOMADS). That makes “don’t ask, don’t tell” impossible.

3. Geographic exclusions lock you out when you roam

Many card policies exclude sanctioned nations, zones with active travel advisories, and sometimes even your expat staysure favourites such as parts of Mexico or Thailand. Wander into an excluded country and you’re self-insured. Specialist expat health insurance plans let you customise regions or buy truly global zones (often excluding only the USA for cost control).

4. Medical caps feel generous—until a real emergency

A US$25,000 emergency-medical limit looks fine on paper. Yet a three-day ICU stay in Singapore can reach US$30,000. Evacuation to your home country can triple that. Full-scale nomad healthcare products routinely cover US$1 million or more, with evacuation to “nearest centre of excellence”. That difference is literally life-saving.

5. Routine nomad health isn’t part of the package

Credit-card insurance ignores dental check-ups, prescriptions, therapy, vaccinations, and maternity. Long-stay nomads still need those services. Comprehensive travel insurance annual policy or dedicated expat health insurance fills the everyday-care gap while still protecting against crises.

6. Visas demand proof beyond your card statement

Embassies don’t care that your bank markets “free medical cover.” When nomads travel for more than a quick holiday, consular officers look for a stamped insurance certificate that lists the insurer’s licence number, the policy’s start- and end-dates, the region of cover, and a minimum medical limit. Most Schengen missions insist on €30 000 of health care plus repatriation that is valid in every member state. Estonia’s digital-nomad visa spells this out in black and white, requiring a policy that “covers the whole Schengen area” with at least that sum in benefits.(VisaGuide) Credit-card insurance rarely meets the limit and can’t issue a standalone letter, so the application is rejected before the interview even starts.

Spain is even stricter. Its telework permit asks for a policy bought from a company authorised by the Spanish Insurance Directorate, and the consulate keeps a public list of approved underwriters.(Ministerio de Exteriores) Portugal’s D-8 (remote-worker) visa also requires private cover that is valid for the full four-month entry visa and the two-year residence card that follows.(Get Golden Visa) The rule applies to spouses and children too, so a family of four needs four certificates, each naming every traveller. Swipe-and-go card perks simply can’t scale to that paperwork.

Duration is the next hurdle. Most credit-card policies lapse after 30–90 consecutive days abroad, but the visas above demand proof for the entire authorised stay. If you plan twelve months in Lisbon, the document must show twelve months of continuous nomad healthcare and evacuation benefits. That pushes digital nomads toward purpose-built products: an annual multi trip insurance plan if you will pop home between stints, or a full expat health insurance contract if you intend to settle. Providers such as Staysure issue a printable confirmation within minutes of purchase; travellers rave about that speed in every staysure expat insurance thread. World Nomads will e-mail a visa letter on request—just ring the world nomads phone number—while SafetyWing adds the PDF to your dashboard; see any recent safetywing insurance review for screenshots.

Price is no longer an excuse. The premium on a mid-tier travel insurance annual policy works out to roughly one coffee per week, yet it unlocks work visas, residency cards and, most importantly, real care when nomads traveling need it. Scan a recent world nomads review or compare quotes through expat Staysure and you’ll notice a pattern: the insurers who know the visa game bake the certificate into the checkout flow. That single page of A4 is worth more at the border than any glossy platinum card.

7. Multi-country itineraries need flexible annual multi trip insurance

If you bounce back to your passport country once a quarter, an annual multi trip insurance policy looks smart. It resets trip length every time you fly out. Credit-card perks rarely work that way; limits accrue across the year. Purpose-built travel insurance annual policy products (e.g., Allianz AllTrips, Staysure’s “Worldwide”) reset automatically and scale benefits far above card caps.

8. Real-world claim nightmares

- Alex, a coder from Canada suffered appendicitis in Bali. His Visa Platinum medical cap maxed out after surgery; evacuation cost another US$12 k he had to crowd-fund.

- Maria, a UX designer broke her collarbone kite-surfing in Brazil. Her card policy excluded adventure sports. A dedicated SafetyWing insurance review shows their Remote Health tier would have paid because kite-surfing counts as “leisure sport.”

- Dieter, a German videographer realised too late his trip exceeded 90 days; reimbursement denied.

9. Specialist providers compared

| Provider | Strengths | Typical drawbacks |

|---|---|---|

| World Nomads | Flexible one-month extensions, adventure-sport cover, 24/7 help at world nomads phone number | Expensive for long trips; caps at six months without a homeward leg (see any recent world nomads review). |

| SafetyWing | Monthly subscription, children under 10 free, COVID cover; solid feedback in every new safetywing insurance review | U.S. visits cost extra; claim portal still improving. |

| Staysure | UK-rooted, strong for 50 + travellers; “Explorer” tier includes unlimited duration after first trip; their staysure expat insurance line issues visa letters fast | Under-65 age bias on some extras. |

| IMG & Allianz | High medical limits, custom deductibles | Pre-authorisation paperwork heavy. |

| Cigna Global | Seamless upgrade path to full expat health insurance | Premiums spike with age. |

All three beat any credit-card wrapper on evacuation, pre-existing-condition waiting periods, and routine care.

10. Legal fine print: the pre-existing minefield

What counts as a “pre-existing condition”?

Insurers define it as any illness, injury, or symptom for which you:

- Sought advice, diagnosis, care, or treatment before your policy’s start date.

- Took medication (even an over-the-counter inhaler) during the “look-back” window—typically 60 days for trip insurance, 180–730 days for many credit-card policies.

- Should reasonably have known existed—even if you never saw a doctor. That vague clause lets a claims adjuster argue that “recurring stomach pain” you ignored was evidence of an ulcer.

Why credit-card policies are extra strict

| Feature | Typical credit-card wording | Impact on digital nomads |

|---|---|---|

| Look-back period | 180 days to 2 years | Any routine prescription (thyroid meds, acne cream) triggers scrutiny. |

| Automatic exclusion | Most pre-existing conditions not covered, period | You must prove the emergency is unrelated—a tall order in a foreign ER. |

| Medical stability clause | You must remain symptom-free for 90 days before departure | A flare-up of controlled asthma voids cover. |

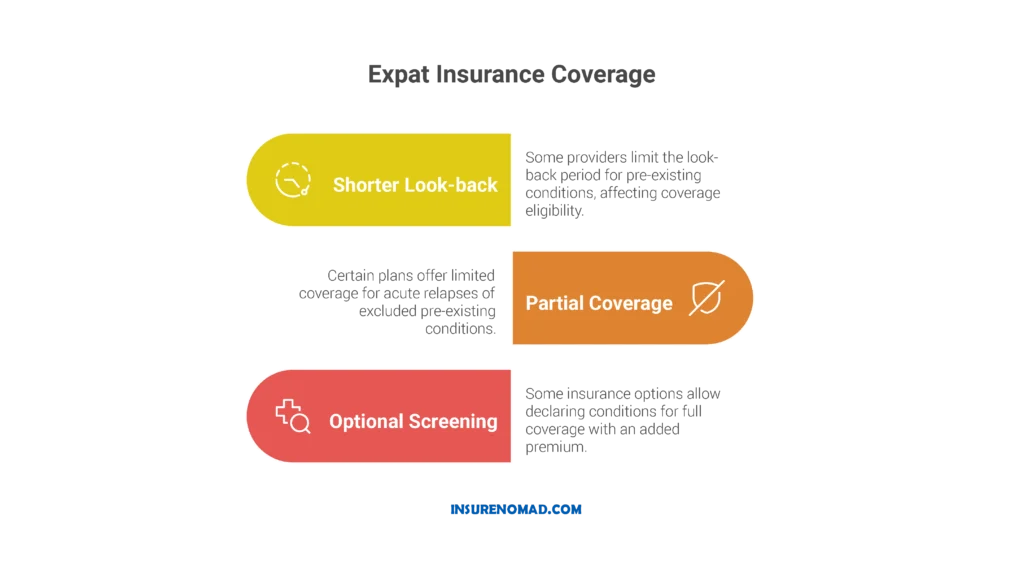

How specialist nomad policies soften the blow

- Shorter look-back – Providers like SafetyWing cap it at 12 months; IMG Global at 6 months.

- Partial coverage – Some pay up to US $25 000 for acute relapse even if the condition is excluded elsewhere.

- Optional screening – Plans such as Staysure expat insurance let you declare a condition, pay an extra premium, and lock in full cover. That letter also satisfies visa officers.

Scenarios that trigger denials

- Unreported migraines develop into a hospital stay in Lisbon → insurer finds pain-killer receipts on your banking app.

- Old knee injury re-tears while surfing in Bali → records show past physio sessions; claim rejected as “degenerative.”

- Mild depression treated with SSRIs → panic attack abroad deemed “related,” mental-health bills unpaid.

Smart tactics to stay covered

- Tell, don’t hide. Declare every diagnosis, even “minor” ones. Honesty lets underwriters price risk instead of denying claims.

- Request a “fit-for-travel” note from your doctor dated within 30 days of departure; attach it to your policy docs.

- Pick rolling-month cover if you expect treatment changes—easier to update disclosures.

- Keep proof of stability. Pharmacy logs showing consistent refills and no dosage hikes back up your claim of control.

- Carry translated summaries of medical history; foreign hospitals file them with the insurer, speeding approval.

11. Claim process speed matters

Cards ask you to liaise with a third-party administrator; there is no dedicated app. Global nomad insurers provide online dashboards, direct-pay hospital networks, and triage via the world nomads phone number or SafetyWing’s WhatsApp line. Faster claims mean less stress when Wi-Fi is shaky.

12. Cost breakdown

- Premium credit-cards charge US$400–700 annually.

- Add US$10–15 per flight in foreign-transaction fees.

- A mid-tier annual multi trip insurance plan from Staysure costs ~US$350, offers US$10 million medical, and lets you pay no FX fees with a fintech debit card.

Net result: full medical security for roughly the same out-of-pocket spend.

13. Transition strategy for existing cardholders

- Keep the rewards card for lounge access and flight delay benefits.

- Buy a travel insurance annual policy that matches your longest likely stint abroad.

- If relocating, upgrade to region-specific expat health insurance within 90 days of arrival to avoid new waiting periods.

- Store PDF copies of both policies in the cloud plus offline.

- Save the world nomads phone number or equivalent SOS line in your favorites.

14. Extra perks full policies add

- Tele-doctor sessions—priceless when nomads traveling in remote valleys.

- Mental-health support after long stints alone.

- Liability cover if your e-scooter dings a BMW in Lisbon.

- Gear protection that actually covers laptops (check every world nomads review for real-life payout stories).

15. Objections answered

“I’m young and healthy.” Accidents ignore birth certificates. Credit-card policies deny extreme-sport injuries—exactly what makes Bali weekends fun.

“Hospital bills are cheap in Southeast Asia.” A single med-evac to Bangkok runs US$20 k.

“Extra insurance is complicated.” Not true. A five-minute online form buys nomad healthcare that auto-renews monthly. Providers like SafetyWing send e-mailed visa letters within hours.

“I already pay for my expat gym membership.” Skip one month of lattes and you’ve funded a month of nomad health cover.

16. Key take-aways

- Credit-card insurance was built for two-week breaks, not perpetual wandering.

- Policy caps, duration limits, and exclusions leave gaps bigger than your carry-on.

- Purpose-built annual multi trip insurance, travel insurance annual policy, or full expat health insurance secures both emergencies and everyday care.

- Compare providers; read at least one world nomads review and one safetywing insurance review before buying.

- Store the world nomads phone number and Staysure’s hotline. Peace-of-mind is a phone call away.